Correction of a credit note

Just like with recorded invoices, you cannot delete a credit note once it has been closed.

However, you can correct it using an invoice (similar to how you would correct an erroneously issued invoice with a credit note).

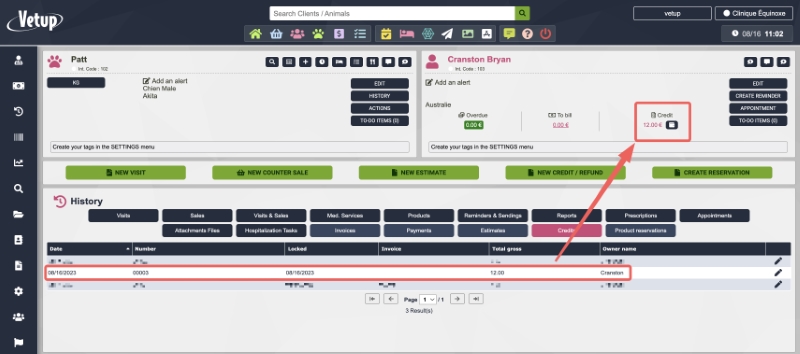

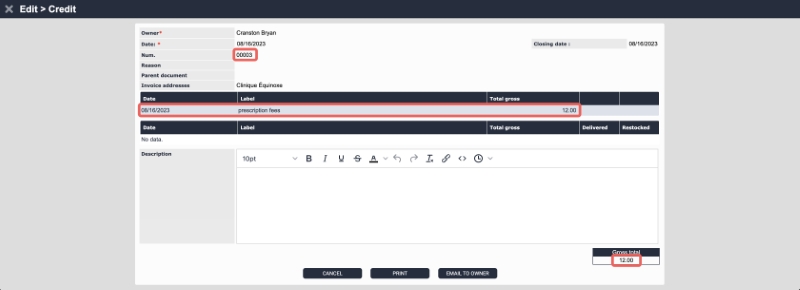

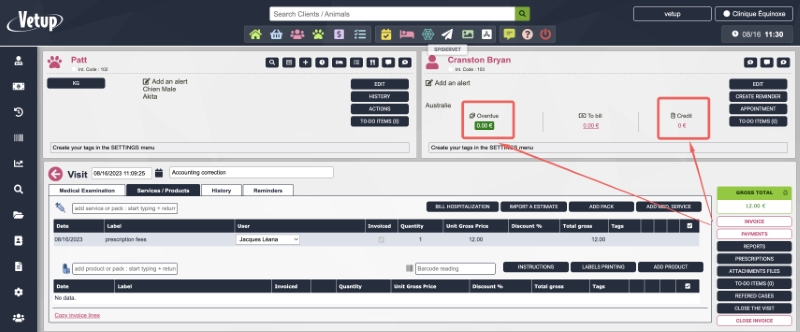

- Example: Mr. Cranston has a credit note of $12 for prescription fees.

This credit note was created by mistake and you want to delete it.

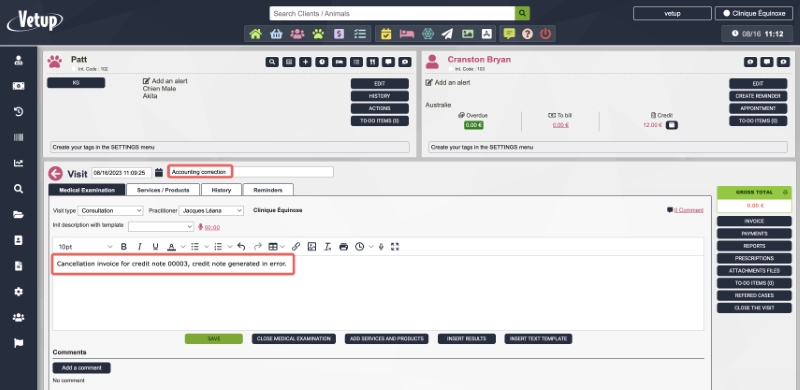

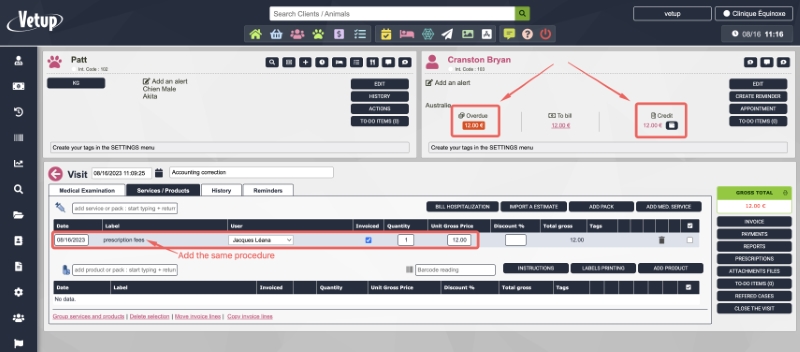

- You will generate a credit note cancellation invoice through a new visit with the same act (service), along with the reason for creating this consultation line.

- Now you have an outstanding balance of $12 as well as a credit note of the same amount.

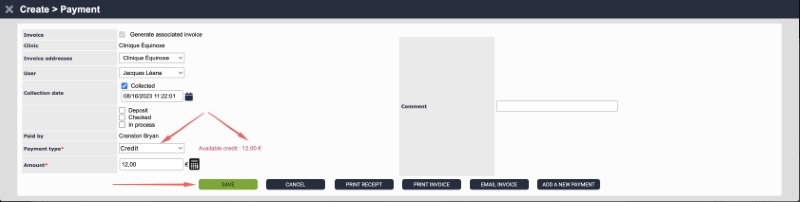

- All that is left is to record a payment with the ‘credit note’ payment method.

- This way, the client’s balance is back to $0, he no longer has outstanding balances or credit notes (since the credit note has been cleared by the previously generated invoice), and there will be no duplicate VAT entries in the accounting.